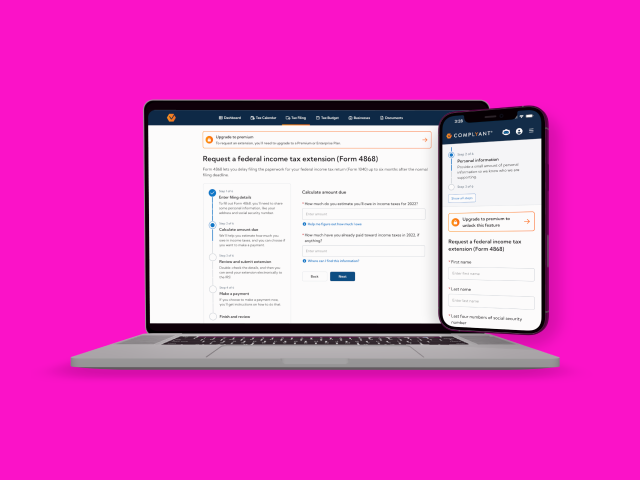

How we empowered small business owners to prepare for tax season—automatically.

TLDR

I co-developed the Plaid domain for ComplYant’s tax estimate feature, crafting a vendor-agnostic integration layer with clear service boundaries, fluent APIs and event-driven flows. Working in tandem with the Hurdlr team, we delivered a seamless user experience that turned live transaction data into automated tax estimates—paving the way for future tools like Schedule C generation.

You’re a small business owner juggling client work, invoices, and admin tasks. You’ve signed up for a platform that helps you stay compliant— and its already helping you track tax deadlines, and the forms and deduction categories your business qualifies.

But taxes aren’t just about knowing when to file. You also need to know how much to save. Our goal was to bridge that gap.

We envisioned a proactive system that estimated users’ quarterly taxes using real-time business transaction data—giving them clarity and confidence as they saved and planned throughout the year.

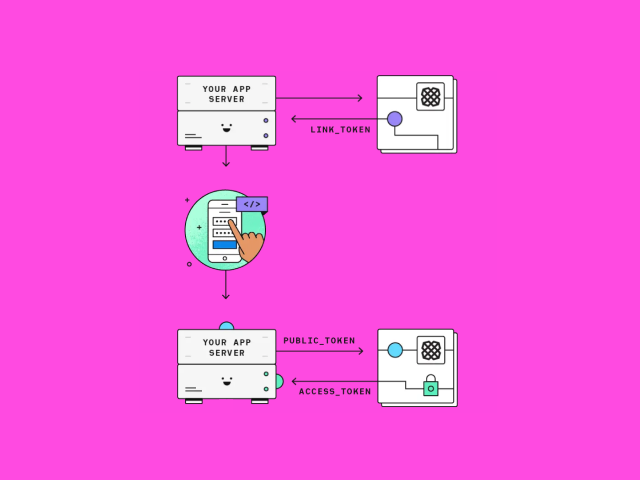

Develop the core functionality for Tax Estimation by ingesting, storing, and interpreting business bank transaction data (via Plaid) and transforming it into real-time tax estimates using a third-party tax API (Hurdlr). Longer term, this system would also support auto-generating IRS Schedule C forms and personalized deductions based on tax ID types.

I co-developed the Plaid domain, designing a vendor-agnostic integration layer with clear service boundaries, fluent APIs and event-driven flows.

Feature planning & architectural design →

- ERD mapping, flow charts, schema mapping and documentation to align team understanding and scope.

- Successfully proposed adoption of Saloon to standardize third-party API integration

Domain design & implementation →

- Built the OAuth flow and Plaid Link integration for connecting users' business bank accounts.

- Developed a fluent service layer for Plaid API operations

- Normalized, validated, and shared data with DTOs

- Built event driven flows using Plaid Webhooks for domain resource sharing (Hurdlr, Expense Tracking, Tax Budget)

- Standardized errors and messages using interface-driven exception translation (improved debugging and user experiences)

Testing & maintainability →

- Successfully proposed adoption of Saloon fixtures to record (thoughtfully redacted) live API responses used for test mocking

- Designed factories to assist in test readability, edge cases, and behavior isolation

- Test domain logic and prevent future regressions with unit tests

We launched the Tax Estimates feature successfully, enabling users to:

- Connect business bank accounts

- View categorized expenses and real-time estimated tax obligations

- Begin preparing for tax season ahead of deadlines

The groundwork laid in the Plaid domain also set the stage for future functionality, including Schedule C form generation, custom write-offs, and more intelligent tax planning tools. Unfortunately, the Schedule C feature was in active development when the company was unexpectedly wound down.

Tools and Tech Stack

Design

Backend

Build Tools

Testing

Workflow

Coming soon.